Step-by-step guide to bootstrapping your new product development – Part 3, Understanding the Beachhead Market

Endjin spend a lot of time working with start ups and businesses who are pivoting into new product areas. They are usually operating under fierce resource constraints, and this has an impact on the way in which they can approach their development program.

We've evolved a principles-based approach to the new product development process which can be applied to a wide variety of businesses. It's based on the MIT disciplined entrepreneurship approach, incorporating great tools like the Value Proposition Canvas and the Business Model Canvas.

In this series, we're going to look at an example of a "lean" new product development process, applying these principles, and looking at some of the caveats.

There are 10 parts in the series, of which this is part 3.

- Principles

- Inception

- Understanding the Beachhead Market

- Competitive Positioning

- Getting to paying customers

- Follow-on markets

- Business model design

- Validation

- Iteration

- Organizational structures to support this model

Part 3: Beachhead market

We've now got a very rough sketch of our product and its fit to the beachhead market. We now want to focus right in on that market, and better understand the size of the market, the customers, and our proposition to them.

8) Build an end user profile (0.5 - 1 day)

We're going to take our example Persona for this market (and the other collateral we gathered about them), and lightly sketch personae for the various types of purchaser that fit this segment.

We'll also now sketch personae for the other people who will be involved in the buying decision e.g. Budget holder, Influencers, Purchasing department, Life partner, Children - whatever is appropriate for your product.

Cross-reference against the customer interviews that you did earlier, and verify that these people really exist.

9) Calculate the Total Accessible Market (TAM) for the beachhead (0 – 0.5 day)

We can now start looking at the size of the market, and validate that it really is worth going after.

The Total Accessible Market, or TAM, is the amount of annual revenue that your business would earn if you achieved 100% market share in a particular market.

You are looking for a conservative, defensible estimate. This will later inform the success metrics for your short-term sales targets!

First, try to do a bottom up calculation of the actual number of users in the beachhead market from your market research, and a finger-in-the-air guesstimate of how much you think they'll pay per year.

For example, you think that the average solicitor might spend £10/month on your product, and there are about 140,000 active in the UK (a quick search of the Law Society tells us), then the total accessible market would be around £16,800,000.

Then, validate against some top-down industry research (e.g. Gartner reports).

A quick (and highly inaccurate) look at the data shows that solicitors earn ~£16bn in revenues in the UK, across ~32,000 businesses. Our TAM would therefore be about 0.1% of revenues.

The total practice management software market in the UK is around £1bn (or 1% of revenues), so our TAM would represent about 10% of that market.

No go metrics

You should set a target for the TAM that looks manageable. It should not be so large that you would need a huge organization to deliver 20 - 30% acquisition, nor should it be so small that you would struggle to see any meaningful revenues when you only have 5%.

In our example, 5% acquisition equates to about £800,000, 50% acquisition to about £8m.

10) Build a single detailed persona (0.5 day)

Now, we want to focus on a single end-user persona. This is going to be the detailed profile of the one exemplar persona for this market. Everyone who will be involved in creating and selling this product, from sales & marketing, to development and finance will focus on and share this customer persona. It will become the touchstone for the product.

It's a good idea to add a bit more detail about them at this stage - more demographic information, likes, dislikes, the things they like to do in the leisure time, their habits at work.

However, the most important thing is to build out their purchasing criteria. Why will they choose to buy a product like yours?

There are a number of drivers you might consider:

- What do they fear the most?

- What excites them the most?

- What will get them fired or promoted?

- What will help their family?

- What will make them laugh?

It's a good idea to review this with everyone involved in the project, and base it on real customer interviews. The exact list of drivers you come up will be determined by the nature of the product, and the details of the persona.

Use the red/orange/green dotting system to determine which are positive and weakly/strongly negative drivers for your product.

No go metrics

You do not have a strongly positive match between the drivers you've brainstormed and your product.

You cannot agree a common set of drivers for the examplar persona, or you feel that it doesn't cover a sufficiently broad spectrum of the buying personae you elaborated.

11) Note: if it is a two- or three-sided market, build additional personae as per step 10.

You don't have to do all of these in parallel – do them in series, from primary persona, and make go/no-go decisions in turn. It will save you unnecessary work if the primary persona is not a good fit.

12) Build a full lifecycle use case (0.5-5 days)

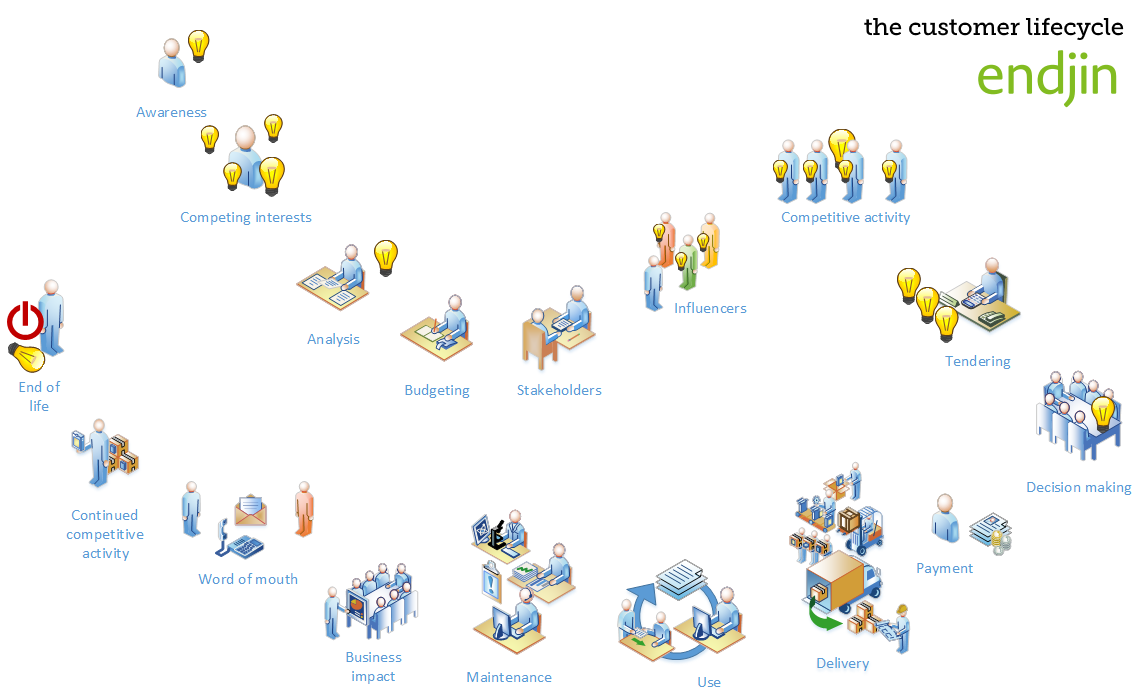

Next, we're going to sketch a first example of the full-lifecycle use case for the product. We'll be adding to this as we explore in more detail.

This is not just the golden-path user journey through the product's features, but covers off the whole engagement from first awareness, through to end-of-life.

Typically, we use a workshop session to brainstorm the journey - perhaps spending a bit of time on desk-based research and customer conversations if we feel we are floundering.

- How does the customer become aware of the product?

- What are the customer's competing interests?

- How will they analyse your product?

- What is their buying process?

- Budgeting

- Stakeholders

- Influencers

- Competitive activity

- Tendering

- Decision making

- How do they pay?

- How is the product delivered?

- How is it used?

- This must be elaborated with real customer(s) until they understand exactly what they will do, and how they will benefit from it. For example, what do they want to achieve by using it?

- Is it used to complete a larger task?

- How often will it be used?

- Will usage remain steady over time or alter?

- How is it maintained?

- What are estimated costs of operationally maintaining the customer / required headcount

- What impact does it have on their business?

- Do they need training?

- Do they need to change business processes?

- Do they resell the product or some service build from the product?

- How will they talk about your product, and to whom (i.e. word of mouth)?

- Do competitors continue to work on the client during the usage lifecycle?

- Why would they end-of-life/discontinue the product, and when?

No go metrics

We use the red/amber/green dot analysis to identify points that are in our favour or weakly/strongly negative, and set a threshold for go/no-go.

The assumptions whiteboard

This is also a great time to start maintaining an assumptions log. Anything that you've guessed, or is not backed up by strong, statistically valid data about your market, should get written down on a whiteboard and placed in a prominent position. These assumptions are what we are going to test later in the process.

13) Build a high level product specification (1-5 days)

We now want to test versions of our basic proposition with real customers. This step is primarily about benefits (either "gains" or "pain relief"), and how appealing they are to the customer.

- Describe 4-5 key benefits

- Describe for each, describe 1-3 key features that deliver those benefits

- Build a storyboard/wireframe that illustrates how the user accesses those benefits

- Design experiments to solicit quantitative feedback about the customer response to those benefits

- Could be a website, 2-sided A4 brochure with a phone number

- You could explore feedback via a focus group, a survey, a Facebook quiz

- Clearly elaborate the product benefits and the way the customer accesses them

- Don't worry about USPs/competitive issues or pricing – you are trying to determine if your proposition is fundamentally engaging and understood by your customer.

- Each experiment should try to isolate one particular benefit

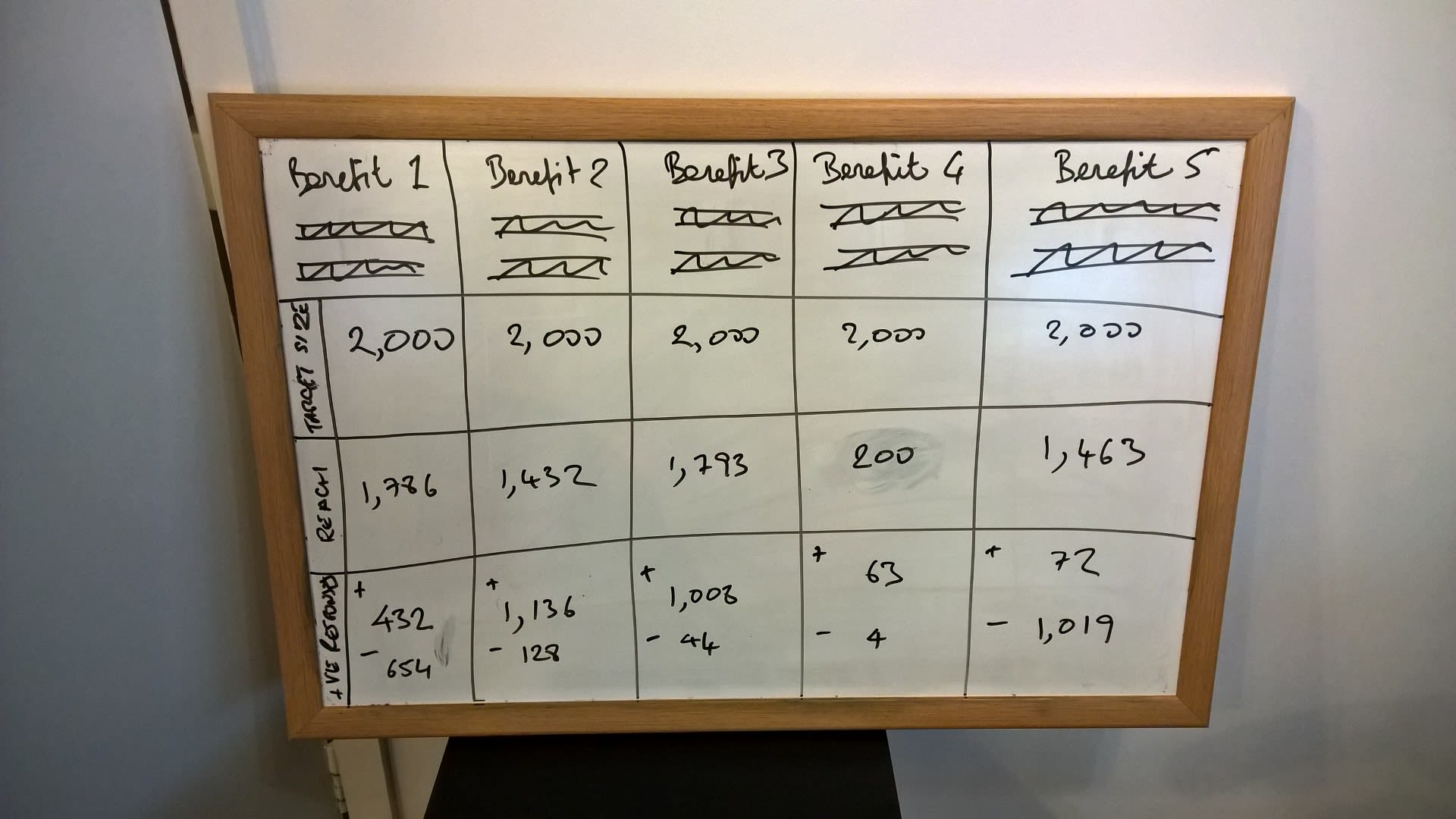

While we're running these initial experiments, we suggest you track the targets on a whiteboard.

No go metrics

Set quantitative targets for the number of customers you have the time and budget to reach (e.g. 2, 10, 100, 1000?) with each experiment.

Ideally, use "friends and family" customers at this stage - people who will be prepared to tell you how it is, and give you proper, detailed feedback.

Design the experiment to get a quantitative result (e.g. number of positive clicks, survey ratings)

14) Quantify the value proposition (0.5 - 1 day)

Based on the journey and feedback from these initial experiments, we'll represent the results in the form of a value proposition canvas.

This sets out the proposition clearly, and demonstrates its market fit.

(I'd include an image of the value prop canvas here for you, but unfortunately, the terms of use are such that we cannot reproduce an example here, even of a derived version. You can see one at the link above, however.)

We'll also attach some concrete numbers to the benefits they are seeing.

Focusing on the persona's priorities and benefits from the product specification:

- Define the as-is state

- Define the "possible" state after using the product

- Summarize the tasks they carry out

- Summarize the product features / offering

- Quantify the value delivered: gains (positive outcomes and benefits) made, pains relieved, opportunities created. Use metrics such as the amount of time/money/headcount the customer saves, their increased market penetration or decreased time-to-market, revenue growth, or increased profitability - or whatever is appropriate for that customer

- Quantify the strength of response/importance of the feature to customer from the survey/focus group work done in section 13 above. This represents the quality of the match.

- Express on a Value Proposition Canvas.

The ideal canvas would show a complete problem / solution fit, where the product addresses all of the customer's pain points and desired gains, and the quantitative gains are significant.

No go metrics

Set thresholds for the quantitative gains the customer makes.

Set a threshold for the total quality of match between the proposition and the customer.

15) Identify the next customers (5-10 days)

So far, we've been talking to the "low hanging fruit" - real customers, but friends and family.

The next question is: can you find more customers who are highly interested in your proposition?

This helps us avoid the pitfall of opportunistically going after one "clear and present" customer, and hand-waving the total potential size of the market.

This is the first experiment to test our sales plan.

In the sketch of the full-lifecycle plan above, we identified ways in which the customer would become aware of our product. We're now going to conduct a series of experiments to test those assumptions, and see whether we can get broader customer engagement.

The basic form of these experiments will be something along these lines:

- Identify a number of potential customers who fit the persona you elaborated in detail

- Use your sales network to engage with them and get feedback on your proposition

- Don't ask questions like "does this look like a good product"

- Do ask questions like "would you be interested in buying a product like this today"

- If not, find out why not.

- In either case, keep asking "why" until you understand

- What percentage of the target customers bite?

Exactly how this is done depends on your sales strategy. Is this a partner sale, or an internet marketing opportunity? Do we need to send people in suits to our customer's front door, phone or email, or set up a facebook group? Each option has different costs and benefits.

As always, don't get too hung up on the detail, and focus ruthlessly on the minimum amount of work needed to get meaningful metrics. You're not trying to win sales for your as-yet non-existent product, you're trying to validate the proposition with people in the market who don't already know you.

No go metrics

Set quantitive metrics for the total time and cost to identify a specific number of customers, and the percentage/absolute number of respondents who express an initial buying interest.

At the end of this section, we have a good understanding of our beachhead market, and the kind of proposition which will address the opportunity in this market. We can be fairly confident that there are a significant number of people out there who might part with their money in return for our goods and services, all things being equal.

But all things are not equal, and in the next part we're going to drill into the competitive position a little more.

Read more in the series